We all know having a good credit score is important, but is it actually more important than cash?

Alex Miller, serial entrepreneur and CEO of Alex Miller Credit Repair, believes so.

His company, so far, has helped over 500 families get approved for their first homes and over 2,000 people increase their credit scores.

There’s no question that having a strong credit score of 740+ points can help you in many ways, including: Having more credit card options, being able to get loans for your house, and taking out a car loan at a much lower interest rate than the average American.

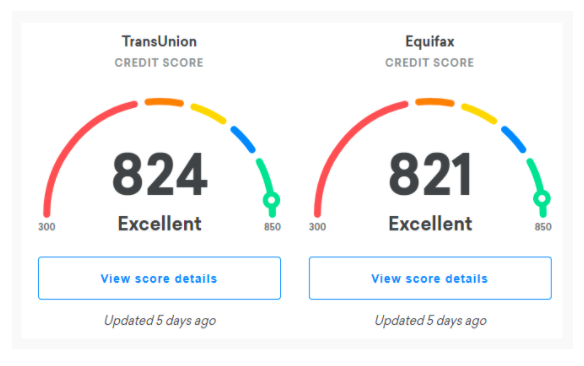

According to creditscorecard.com, credit scores range from 300 to 850 points.

On this scale, for example, a score of 750 and up is considered very good and scores of 800 or above are considered excellent.

According to FICO, as of last fall, a full 22% of those with credit scores were in the 800 plus club, and another 20% scored between 700 and 750.

How many had a perfect 850? Just 1.5%, according to Ethan Dornhelm, vice president of scores and predictive analytics at FICO.

Usually, an 850 won’t get you a better deal on credit than an 800. But that 800 will, for example, get you a better rate on a mortgage than an average 704.

When it comes to credit score maintenance, Alex Miller’s main advice for maintaining your credit score is not getting any late payments.

One single late payment can drop your score over 100 points.

Alex Miller, a master in repairing credit, shares the two step process he uses to change people’s lives and finances in the process.

“Step 1 is to delete the inaccurate negative accounts. We do this with our proven strategy called the ‘3 Round Burst’. Each round is 40 days of advanced master disputing. Your scores will increase according to how many positive accounts you have after we delete the negatives. If a person does not have any positive accounts they have to build credit,” pointed out Alex Miller.

“Step 2 is to introduce them to a few of our credit building programs will quickly build their credit scores within 45 days,” added Alex Miller.

To Mr. Miller, helping people improve their credit is much more than a business, to him, it’s about helping people across the country realize their own version of The American Dream.

To learn more about how to improve your credit and reach financial freedom, you may follow Alex Miller here.